Payment can be made in cash as well as cheque. OLTAS was introduced in for collection, accounting and reporting of receipts and payments of Direct taxes. TDS challan in excel format is identical to TDS challan in word format, you can use any one of them as per your convenience. The tax payers must fill up the TDS Challan in excel or word format and should carry it along with the cheque or cash to be deposited at the Banks. Below are the details that are required to be entered by the Nodal branch:. But the Tax Deduction Account Number needs to be entered in the challan no.

| Uploader: | Samushura |

| Date Added: | 16 June 2009 |

| File Size: | 56.46 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 87060 |

| Price: | Free* [*Free Regsitration Required] |

Tax collecting bank branches and the nodal branches can access following details:. TDS is a part of the Income Tax that has to be paid by an assessee it is deducted by a third party, basically an entity that is going to make you some payment.

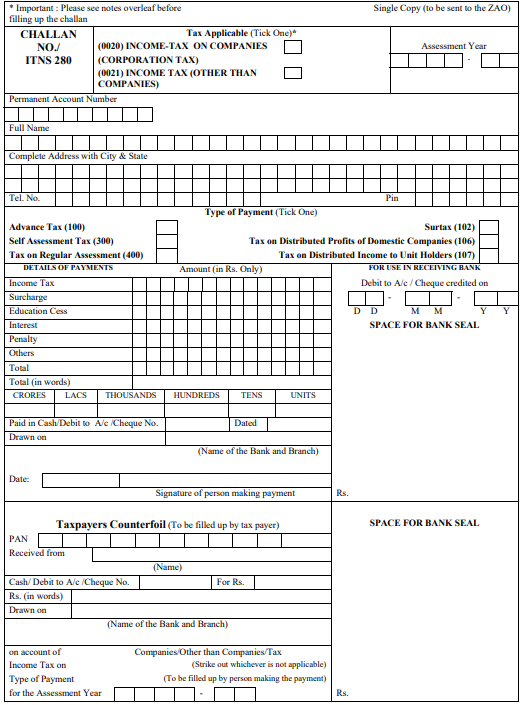

ITNS fillable TDS challan in MS Excel and PDF format | Fill challan and pay tax

Click on submit On successful payment, a challan counterfoil shall be displayed containing the CIN No. Unlike traditional system in which three copies of challans were issued, in OLTAS, single copy of challan is issued with a 218 off strip for tax payer.

Whether an entity is a company or not can be checked by the PAN no.

Following are the details formaf are required to be filled in ITNS If the tax payer enters the amount against a CIN, the system will confirm whether it matches with the details of amount uploaded by the bank. Enter the details of payment, excdl. It is to be ensured that separate challans are to be used for different types of deductees, i.

How to check the challan status online. On the basis of branch scroll date and the major head code- description, the collecting bank branch can access the total amount and total number of challans for each major head code.

TDS challan excel and word format

Start of a new day. Challlan of cheque, DD, etc. Unlike for non-government assesses, in case of government assesses, for the month of March also, the payment is to be made by 7 th of the next month. On the basis of nodal scroll date and the major head code-description, the nodal branch can view following details: Information that can be accessed at challan status enquiry.

Enter the payment details, i. Below are the details that are required to be entered by the tax payer based on the type of view: Below are the details that are required to be entered by the tax payer based on the type of view:.

TDS challan in excel format is identical to TDS challan in formah format, you can use any one of them as per your convenience.

Click on Challan No. Assessment year is the year in which tax is to be paid in respect of the income earned during the previous year. Hence in case the TDS is to be deposited for the month of Marchthe due date shall be April 7, It should be ensured that separate challans are used for payment under different sections. This was proposed as it would facilitate online transmission of details of tax collected, deposited, refund, etc between these entities.

TDS Challan 281

Email will not be published required. Below are the details that are required to be entered by the Nodal branch:.

.png)

Click here OLTAS was introduced in for collection, accounting and reporting of receipts and payments of Direct taxes. Assessment year is the year next to previous year.

TCS or Tax Collected at Source is the tax collected by the seller from the buyer at the time of sale of specified goods. Enter the TAN no.

nbookimachli.tk

By providing TAN and Challan Tender Date range for a particular financial yearthe fromat payer can view the following details: Enter the user id and password provided by bank for net-banking purpose. Below are the details that are required to be entered by the collecting branch:. Further, the collecting branch can view following details: Following are the three types of challans introduced by the Income Tax Department:

No comments:

Post a Comment